"When you see a good move, look for a better one."

- Emmanuel Lasker

I have over three years of work experience in the financial industry. I spent a year at Scotiabank working in Global Wholesale Operations as an OTC derivatives Analyst. I then moved to Majesco, where I have developed and implemented L&H rating algorithms for the past two years.

I have been playing an embarrassing amount of DnD (My Wizard Parting the Sea filled with undead).

My résumé is for those who are interested.

Current Experience

Senior Software Engineer @Majesco

I develop and implement rating algorithms for a variety of Fortune 500 companies.

Prior Experience

Financial Engineer at @First Derivatives

I was a consultant in the Capital Markets industry at Canada's largest banks.

Global Wholesale Operations - OTC Derivatives @Scotiabank

Processed up to 30 billion USD in daily trades, spanning a broad suite of OTC derivative products, including swaps, futures, options, FX, and NDF, resulting in a 35% decrease in monthly outstanding confirmations. Developed and maintained relationships with customers at both the operations staff and management levels, allowing for effective escalations and issue resolution.

Data Scientist @Carleton University

Conducted a literature review spanning 25+ articles to understand how female directors impact the firm. Gathered CSR data from hundreds of firms using Python and various APIs to analyze whether a gender-diverse board is more likely to engage in CSR activities.

Equity Analyst @Sprott Student Investment Fund

Equity analyst of a 1.2 million AUM fund specializing in the Utilities sector. I created an update report for Tencent Holdings Limited using a DCF and relative value that resulted in the fund evaluating the risks of investing in the Chinese market.

Insolvency Assistant @Doyle Salewski

Reviewed clients' budget reports by reconciling their income and expenses with their budget sheets and inputting their information into a database, ensuring clients met their insolvency requirements. Prepared the clients’ Final Statement of Receipts and Disbursements by analyzing their estate's general ledger, statement of affairs, and statement of claims, which led to an all-time high in revenue accruals.

Teaching Assistant @Carleton University

Provided hundreds of students with supplemental assistance in core courses such as Beginner and Intermediate Accounting and Business Finance II. Marked midterms and assignments under a tight 1-week deadline while providing constructive feedback for all students

Projects

Trading Floor Display - RGB LED Stock Ticker

Created an LED Matrix powered by a Raspberry Pi that displays daily stock pricing data for up to 100 companies and their corresponding company logo. Utilized an abstract factory design pattern to modularize the display design so that future features can be easily added, such as displaying news data.

Tech: Python, IEX Cloud API, Pandas

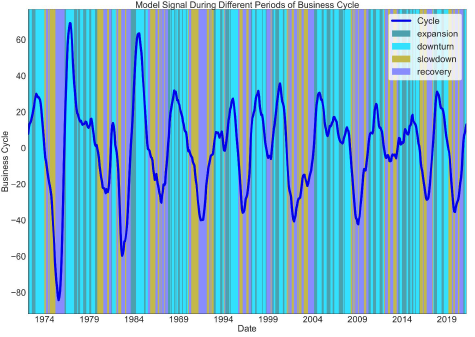

Exploiting Cyclical Economic Trends Using a Sector Rotation Strategy

Constructed a composite index of leading and coincident indicators using Python and Bloomberg's API to track the different periods of the business cycle. Created a signal to identify economic stages in the composite business cycle to buy sector ETFs that have empirically outperformed the broad market during the identified periods and exploit potential inefficiencies with a buy-and-hold strategy.

Tech: Python, Bloomberg API, Pandas, Matplotlib, Seaborn, Numpy

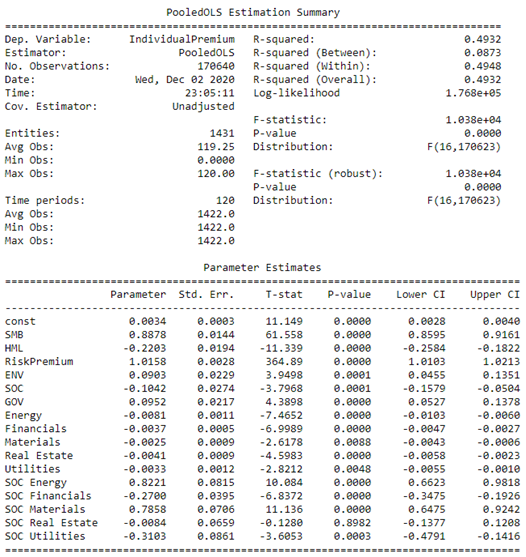

ESG Panel Study

Analyzed ESG scores by conducting a panel study using Fama French and ESG Factors to determine whether a firm's ESG Score leads to higher risk-adjusted returns. Utilized Bloomberg's API by gathering factor data and stock returns to create a Python model that cleaned the data and back-tested the multi-factor model

Tech: Python, Bloomberg API, Pandas, Matplotlib, Seaborn, Numpy

Goeasy Strategic Management Capstone Project

Spearheaded the Industry, value chain, industry, and competitor analysis of Goeasy by using Bloomberg, Excel, and Python to gather and analyze data and present it in both a writeup and a presentation to receive an overall grade of A

Tech: Python, Bloomberg API, Excel, Powerpoint